Introduction

In an ever-changing financial world, smart investors are looking more for opportunities that fall outside typical stock markets. One such growing road is unlisted shares — shares of companies that are yet to get listed on the NSE or BSE. Of these, Metropolitan Stock Exchange unlisted shares have recently been in the limelight contributing to the company’s regulatory pedigree and strategic positioning.

This report on the Metropolitan Stock Exchange unlisted share offer price discusses every thing an investor in the affected securities stock exchange need to know in order to be able to determine whether or not to invest in the Exchange.

Table of Contents

About Metropolitan Stock Exchange of India (MSEI)

The MSEI is one of the three major stock exchanges in India, the other two are NSE and BSE. The exchange, earlier known as MCX-SX which was launched in 2008 and which was later rechristened as MSEI, trades in equities, equity derivatives, currency derivatives, debt and interest rate derivatives, among others.

With credible institutions State Bank of India, Union Bank, Punjab National Bank and IL&FS backing it, MSEI’s shareholder base l end credence to its functioning — even though it’s still unlisted in the prominent bourses.

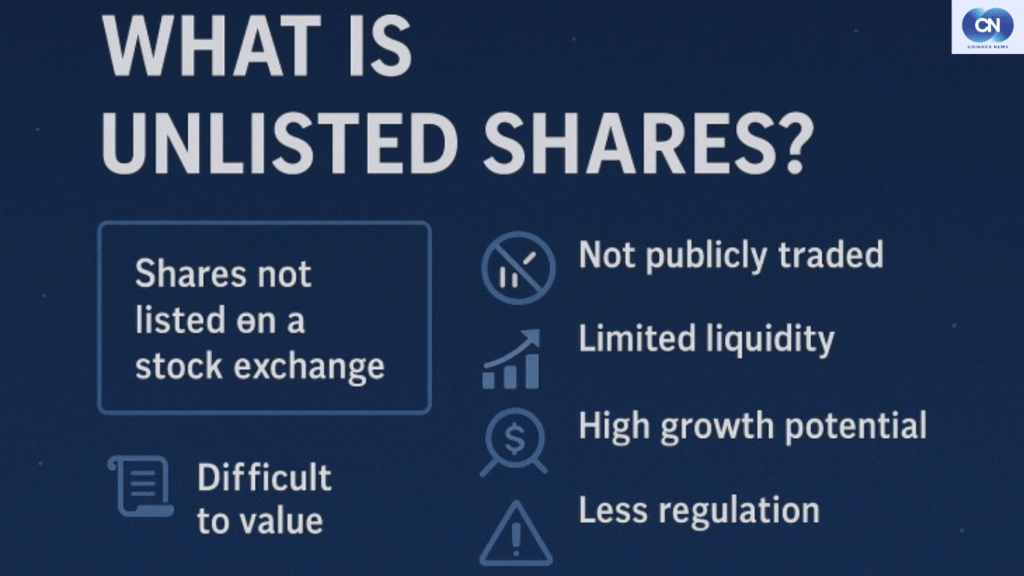

What Are Unlisted Shares?

Unlisted shares refer to the shares of companies that are not listed on regular stock exchanges. Instead, they are bought and sold in the private equity or Pre-IPO market. Those shares are riskier, but could potentially produce much larger returns if the company goes public or is sold at a profit.

But investing in unlisted stocks such as MSEI gives early entry—before the institutional investors come in at the IPO pricing stage.

Metropolitan Stock Exchange Unlisted Share Price: Latest Update

As in July 2025 the Metropolitan Stock Exchange unlisted share price ranged between ₹1.50 and ₹2.50 per share, given that as per the private market deals, as well as brokerage reports. This would make it a pocket-friendly choice for retail investors who want to have an early exposure to the Indian exchange space.

Keep in mind that because MSEI is not yet publicly traded, prices may vary slightly by seller, broker commissions, and how much you buy.

Latest Update: Demand for Metropolitan Stock Exchange unlisted shares had witnessed massive demand in the last quarter on hopes that regulatory changes are in the offing and the exchange has plans to go for listing in future.

Why Invest in Metropolitan Stock Exchange Unlisted Shares?

1. Strategic Market Position

It is one of three national bourses in India. Its restricted competition provides it a natural edge, more so now that financial inclusion expands in Tier-2 and Tier-3 towns.

2. Affordable Entry Point

The current Metropolitan Stock Exchange unlisted share price shows that is a cheap way to get a foul in enriched financial services sector, especially as compared to NSE or BSE shares.

3. Pre-IPO Potential

With these helping hands, if MSEI opts to list itself, it would naturally lead to significant gain in the stock and post-listing again, it might get re-rated to a large extent.

4. Backed by Reputed Institutions

It’s less risky than other unlisted ventures as company has PSU as its stakeholders such as SBI, LIC, IDBI Bank and trust & regulatory support.

How to Buy Metropolitan Stock Exchange Unlisted Shares?

Buying unlisted shares involves a few more steps than traditional stock investing. Here’s a step-by-step process:

Step 1: Choose a Trusted Platform

They are offered at platforms such as UnlistedZone, Shareskart, Planify, or private brokers to trade with Unlisted shares. Look for SEBI-registered intermediaries.

Step 2: Check Price & Availability

Check the most recent unlisted share price of Metropolitan Stock Exchange and note the lot size (generally 1000 shares).

Step 3: KYC Verification

Submit PAN, Aadhaar, bank account details and also demat ABLING FACTORS Creation of assets in a date with the NGO/your chosen target location and sebi HAPPING. KYC is mandatory for compliance.

Step 4: Make the Payment

Usually payment is transferred through NEFT/IMPS. After successful payment, the shares gets credited to your demat account in 24-48 hrs.

Valuation Outlook for MSEI

Market Capitalization Potential:

If listed, MSEI’s valuation could fall in the ₹3,000 to ₹5,000 crore range, considering its peer exchanges and market share.

Revenue Sources:

MSEI earns from:

- Listing fees

- Transaction charges

- Technology services

- Market data sales

Growth Triggers:

- Regulatory push from SEBI for more competition

- Rising retail investor participation

- Increased SME and startup listings

Risks to Consider

Although the upside is interesting, investors should know the following risks:

- Liquidity Risk: Private shares can sometimes be more difficult to resell than public ones.

- Regulatory Uncertainty: Alterations in SEBI regulations can hit the operations of exchange.

- No IPO Guarantee: There is no guarantee that MSEI will go public this year or any time soon for that matter.

- Price Variation: Metro Exchange Unlisted Share price is bound to fluctuate on the private market.

How to Track Metropolitan Stock Exchange Unlisted Share Price Today?

Here are some ways to track the Metropolitan Stock Exchange unlisted share price today:

- You may also check UnlistedZone, Share India and Planify for daily price updates.

- Join unlisted shares investor communities on whatsapp or telegram.

- Get in touch with reliable stock brokers that deal in MSEI shares.

Tip from CoinDCX News: Make sure to check prices from two independent sources before buying.

Expected IPO Timeline

There’s no deadline set but the street buzz is that MSEI would mull over an IPO in 2026 taking into account profitability and SEBI’s bid to improve exchange transparency.

If investor enters at the current Metropolitan Stock Exchange unlisted share price then they would be hitting the jackpot if the IPO pricing is well-above the expected line.

Final Thoughts: Should You Invest in MSEI Unlisted Shares?

If you are an investor looking for unexplored, early-stage, high-upside of India’s financial system, Metropolitan Stock Exchange unlisted shares is an interesting prospect. Low number of entry ticket, strong backers and ever increasing buy-in from investor community makes MSEI one of the quiet gems in the unlisted space.

But as with any Pre-IPO investment, you need to do your homework. Understand the risks, stay on top of the Metropolitan Stock Exchange unlisted share price, and never invest more money than you can set aside without touching it for several years.

Frequently Asked Questions (FAQs)

What is today Metropolitan Stock Exchange unlisted share price?

As in July 2025, the price is between ₹1.50 and ₹2.50 per share depending upon lot size and seller.

How do you purchase Metropolitan Stock Exchange unlisted shares in India?

You can buy them through SEBI-registered brokers or platforms such as UnlistedZone, SharesKart, and Planify.

Is it safe to invest in Metropolitan Stock Exchange unlisted shares?

All investments are risky, but MSEI has solid institutional backing, which makes it less risky than other unlisted companies.

Will MSEI launch an IPO soon?

Nothing has been confirmed, but industry sources expect a potential I.P.O. around 2026.

Do MSEI unlisted shares offer any dividends?

Currently MSEI does not pay dividends. Investors were largely betting on capital appreciation.

How to check the Metropolitan Stock Exchange unlisted share price today?

Verify private equity platforms or phone brokers for current pricing.

What is the investment minimum?

This is dependent on the broker, but usually begins at around ₹1,500 to ₹2,500 for a lot of 1000 shares.